maryland local earned income tax credit

2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. A taxpayer can also claim a nonrefundable earned income credit against the local income tax.

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

. Request Your Free ERC Analysis. See If Your Business Qualifies For the ERC Tax Credit. And you may qualify to receive some of these credits even if you did not earn enough.

See If You Qualify. The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. Required to file a tax return.

The expanded tax credit will arrive as soon as they file their 2020 tax returns and they will be eligible to receive that higher amount for the next three years. See what makes us different. An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov.

502LC also calculates a local tax credit for income taxes paid to another state or to a local jurisdiction in another state for tax years 2012-2014. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Complete Edit or Print Tax Forms Instantly.

In addition the legislation increases the refundable Earned Income Tax Credit to 45 for families and 100 for. Well Handle All Your Filing. To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less.

The amount of the credit allowed against the local income tax is equal to the federal credit. BALTIMORE MD The Maryland Department of Human Services is strongly encouraging eligible Marylanders to take advantage of the Earned Income Tax Credit Benefit. Ad Get Help maximize your income tax credit so you keep more of your hard earned money.

See If You Qualify. Ii Primary Staff for This Report. The state EITC reduces.

HB 680 increases the value of Marylands Earned Income Tax Credit for workers who dont have children and non-custodial parents who arent claiming dependents on their taxes by. The allowable Maryland credit is up to one-half of the federal credit. These credits can reduce the amount of income tax you owe or increase your income tax refund.

Tips Services To Get More Back From Income Tax Credit. Nearly one half of tax filers in two Baltimore City ZIP Codes received an earned income tax credit EITC on their tax returns compared to about 1 in 7 filers for the State as a whole. R allowed the bill to take effect without his signature.

Eligibility and credit amount depends on your income. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. Well Handle All Your Filing.

Ad Access Tax Forms. It is part of your Maryland tax and is added to Form 502 on line 28 as Local Tax. Request Your Free ERC Analysis.

Maryland residents do not get credit for local tax paid to Maryland municipalities. The maximum federal credit is 6728. The payments provide 178 million in relief to 400000 Marylanders.

In May 2019 Governor Larry Hogan R signed legislation to significantly. If you qualify for the federal earned income tax. Download Or Email MD HTC-60 More Fillable Forms Register and Subscribe Now.

We dont make judgments or prescribe specific policies. 33 rows States and Local Governments with Earned Income Tax Credit. See If Your Business Qualifies For the ERC Tax Credit.

Individuals should complete this form to. If you qualify for the federal earned income tax.

How Do State Earned Income Tax Credits Work Tax Policy Center

What Are Marriage Penalties And Bonuses Tax Policy Center

How To Receive The Child Tax Credit And Or Earned Income Tax Credit The United Food Commercial Workers International Union The United Food Commercial Workers International Union

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

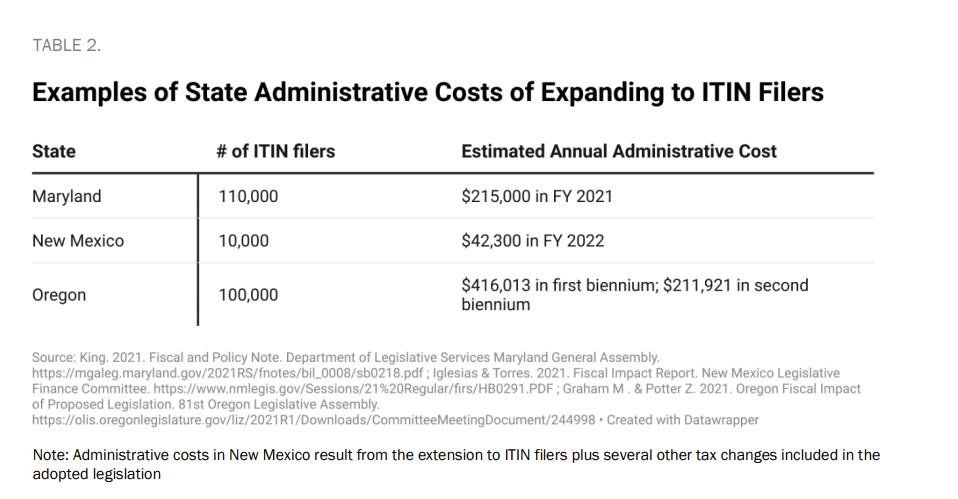

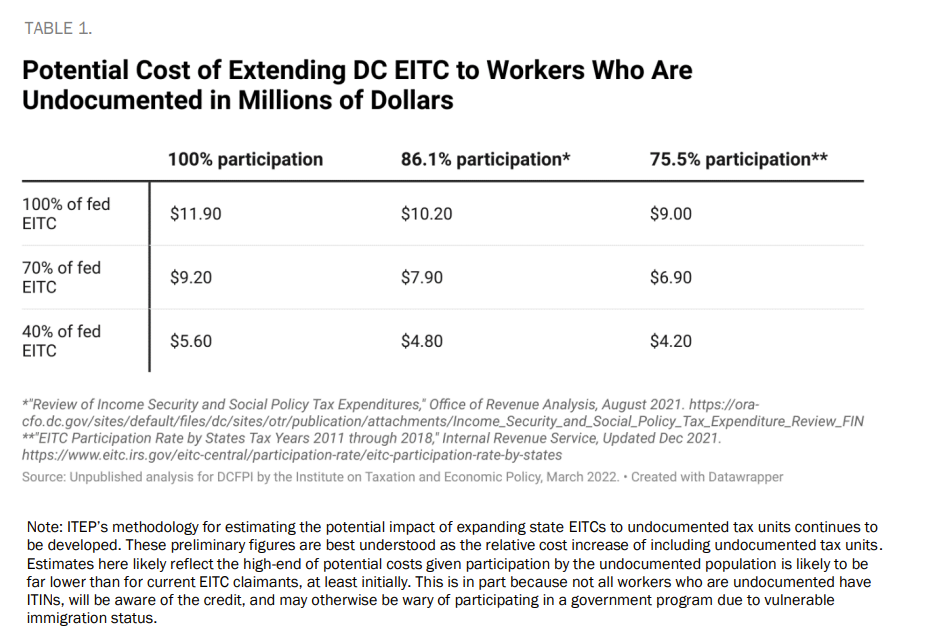

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Child Tax Credit Schedule 8812 H R Block

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Earned Income Tax Credit Eitc Interactive And Resources

How To Get Up To 3 600 Per Child In Tax Credit Ktla

Earned Income Tax Credit Now Available To Seniors Without Dependents

Earned Income Tax Credit Eitc What Is It Who Qualifies Nerdwallet

How Older Adults Can Benefit From The Earned Income Tax Credit

State Earned Income Tax Credits 2008 Legislative Update Center On Budget And Policy Priorities